Banking today is almost unrecognizable from what it once was - in some ways, that is.

In this article you will learn about the future of the bank branch, and the role digital banking and video banking technology will play.

- Digital services vs. the traditional bank branch

- Bank branches today

- The Covid-19 effect; the future of bank branches

- What is the human touch in digital banking?

- What are the benefits of video banking?

- What are the 'Modern Banking Value Steps'?

- 5 ways to measure video banking solutions

What is video banking?

While our parents and grandparents most likely walked into their local branch for every transaction, today - as consumers seek a bank branch for the digital age - we have the option of carrying our bank in our pocket, via mobile video banking, using video banking apps and self-service tools to manage our own accounts from anywhere, at any time.

But many customers still rely on human interaction with bank representatives when it comes to managing, planning, and handling their finances. Banking is, after all, a service that involves personal and sensitive information and important decision-making. For high-stakes transactions and financial advising, it takes a person, not a button, to offer customers the personalized service and peace of mind they need.

So, when should banks focus on digital services, and when are face-to-face interactions still needed? Do customers still even want physical bank branches? And, as consumer banking evolves and video banking technology advances, how can video meetings help to create a modern customer experience?

How retail banks can master customer engagement

Did you know?

Only 10% of retail banks regularly work on enhancing the customer experience

Yet over 70% of retail banks believe that digital customer engagement is important to the success of their businesses today and tomorrow

Customer engagement is essential in today's competitive landscape.

Get your free copy of our guide and learn how to win more customers and scale your business.

Where digital services work just as well - or better - than going to the branch

For years, large financial institutions have been engaged in a digital arms race, which has only been accelerated by innovation from new Fintech companies, and the Covid-19 pandemic, which pushed more established industry players to quickly adopt more digital services. These changes have transformed customer interactions in the financial sector, especially within consumer banking. And it’s no wonder why: digital banking is fast, convenient, and can often keep business costs low for the bank, while speeding up services and response times for the customer.

When it comes to simple tasks like checking an account balance or transaction history, for many customers there’s no need to ever step foot in a bank branch. Direct deposits and automatic bill payments, along with mobile payment apps, means that it’s often easier for consumers to handle their own transactions than spend the time it takes to travel to a bank branch or call to speak with a representative. In these situations, web and mobile banking, chatbots, telebanking, and even social media will often win out for both your organization and the customer, in terms of both time and money saved.

Are branches still relevant in the age of digital banking?

This question is not a new one, and for years, banks have been re-examining the role of the branch as more digital services have become available. In 2016, McKinsey & Company conducted an online Consumer Insights survey of 36,000 consumers across 11 European countries, Canada, South Africa and the United States, to analyze customers’ behavior across channels, their satisfaction with their main bank, interest in innovative services, and willingness to switch to digital and remote channels for advice and sales.

In the United States, 38% of respondents still preferred the branch as the dominant channel for their banking needs. McKinsey called this subset “security seekers”—consumers who sought their local branch or at best an ATM for all banking needs, because they had low trust in remote and automated channels.

Once you added a second category—the “personal bankers” as McKinsey called them, typically senior-aged customers with low tech adoption—the lead was transferred to Germany. Indeed, in most geographies, the percentage of consumers preferring the “bank in my pocket” convenience of remote banking for most transactions and advice was lagging significantly, compared to those preferring direct human interaction at a branch.

The Covid-19 effect, and what it means for the future of bank branches

While numbers above showed that in 2016, a surprisingly high percentage of consumers still preferred in-person interactions at branches, in 2020, everything changed due to the global Covid-19 pandemic. According to a Forbes article, branch transactions fell 30-40% between March and November 2020.

“Banks have planned for years for disaster recovery if their technology failed but have never planned for disaster recovery if their buildings closed,” says Chris Skinner, leading influencer and champion of digitalization in finance, in an article from The Economist. “This is the big lesson of the crisis.”

As Covid-19 has made painfully clear, reliance on brick-and-mortar businesses creates immense vulnerability to unexpected disruptions in the ability to operate. Throughout the pandemic, financial organizations were forced to adopt new collaboration tools for both customer-facing and internal communication. Consumer banks, like so many other businesses, discovered that more could be done remotely than ever imagined.

As a result of this, large banks around the world recently began announcing that they will close a large number of their branches permanently, and it’s no wonder why: maintaining a branch—in terms of staff, technology, and overhead costs—accounts for half the operating costs of some banks according to the McKinsey survey. Turnover for branch staff is high, and it’s harder to track customer engagement than when working with automated channels, yet branches often work with the most complex aspects of the customer relationship.

Read more: How will video communication transform consumer banking in 2021?

Why the “human touch” still matters

Despite the possibilities provided by new digital adoption, the pandemic has also shown us what we lose when in-person meetings aren’t possible, revealing the limitations of digital banking. For many customers, whether it be due to age, personality, social situation, or access to technology devices, digital banking just isn’t enough without the element of human interaction.

And even for the most tech-savvy customers, there will be times in their life and financial situation where the nuances of individual decisions and transactions require customized guidance from bankers, advisors, and sales representatives.

For example:

- A customer’s smartphone can tell him his account balance, but a human being can read his expression and understand the complexities of his financial situation, leading to solutions like a short-term loan.

- Some financial decisions are more complex than what a “do it yourself” service can offer. Customers value personal interactions when they are in need of objective advice and expertise.

- Some customers are wary of the security and effectiveness of digital services, and feel more reassured when an expert is managing their transactions. Speaking face-to-face with someone can boost trust in the organization as a whole.

No matter how advanced automated services become, they will never replace the person-to-person connection that is often critical to providing a quality customer experience, ultimately leading to long-term trust and loyalty. What recent times have shown us, however, is that these interactions don’t need a physical meeting to be successful. In fact, they can be both successful and convenient through the use of video banking.

.jpg?width=800&height=533&name=iStock-1250622576%20(1).jpg)

How does video banking help?

A number of the challenges described above, both for digital services and in-branch banking, can be solved by video banking. Here are some reasons why:

- It’s fast and convenient. People are now more comfortable with video meetings than ever before, and customers can save time and money on travel by joining a remote meeting with their bank. Video meetings can also make customer interactions more consistent and predictable, with less possibility for external disruptions such as local traffic and parking.

- Using video provides human interactions for customers who are skeptical of automated services. Offering the option of video meetings can give your bank a broader appeal to a wider range of customers.

- Key members of staff, often those specializing in a product line or with an established relationship with customers, can be available across more than one branch location at once. During customer meetings, whether over video or in-person, if the bank representative needs a second opinion or sees a sales opportunity for a different product, they can quickly bring a colleague into the meeting regardless of location.

- Video recordings of customer conversations make it easier to assess, troubleshoot and improve interaction scripts, including incorporating upsell opportunities.

- Depending on staff availability, video can make “in-person” meetings as much of an on-demand channel as other digital or telebanking services. This can be especially useful for customers who live in remote areas, have disabilities, or other prohibitions from traveling.

- The diversification of products and services has meant increasing specialization. For some of our clients at Pexip, many of these specialists cover large territories, serving customers across 5 to 10 branch offices. This used to mean traveling for hours each day—until the advent of video conferencing.

- Offering financial advising over video as an integrated part of a bank’s digital services can provide the missing link for digitally-savvy customers who still sometimes need to sit down with a human being but like the convenience of digital banking.

So, what does the video banking experience actually look like? It’s up to you, your organization, and the unique needs of your customers. Pexip’s customization features allow you to design your consumer journey through your products and services, which can be called the solution workflow.

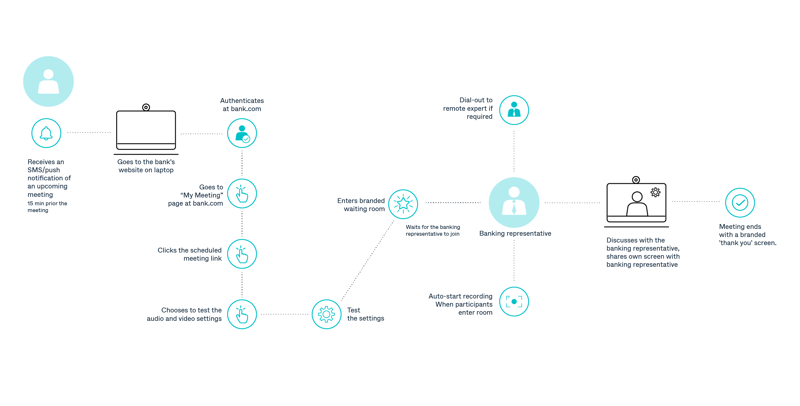

Creating this workflow requires mapping out every touchpoint as you assess how you want to enable video meetings with customers. The simpler the flow you set up, the better your success rate is likely to be. Here’s an example of how Pexip video conferencing can look when integrated with your organization’s customer workflow:

Costs and value of physical vs. digital banking

Of course, one of the main motivators for banks going digital is the immense cost savings when compared with the expense of running a branch. Video can alleviate some of the costs of holding in-person meetings, but quality video conferencing technology and hardware is also an investment that should be weighed within the overall goals of the organization.

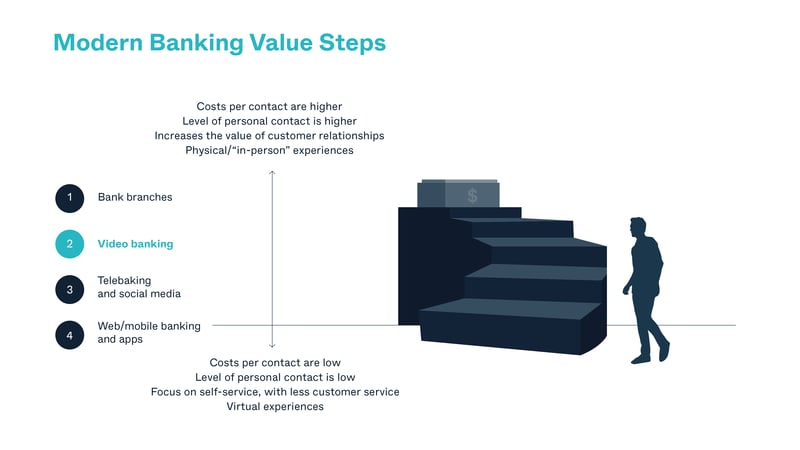

The figure below shows how the Modern Banking Value Steps increase costs in tandem with personal contact. Video banking, which is a digital form of personal contact, is on the higher end of the spectrum when it comes to cost, but considering its potential for boosting customer retention and revenue streams that rely on customer loyalty, it's an investment that has the potential to provide long-term value.

Getting the most out of video banking

For video banking to be a valuable element of your customer-facing services, it needs to be implemented in a way that allows the solution to make your customer interactions and internal communications easier, not more complicated. When choosing a video banking solution that ready to do the work for you and scale as you need it to, consider the following:

- Easy-to-join meetings that don’t require downloads or plug-ins, and are quick to join from any device or browser. The quicker customers and staff can access their appointments, the happier they will be.

- Security. When it comes to financial services, privacy, meeting security, and data protection are critical considerations when choosing a service.

- Customized branding and customer journeys. By having video meetings that feature your company’s colors and logo, and be integrated into your website’s UI, your customers will feel more confident in the service and be assured that they’re in the right place.

- Interoperability. As we have discussed, there remains a need for some physical bank branches, and employees will continue to take meetings from their offices and conference rooms. When those meetings happen over video, they should be easy to join from in-office video conferencing infrastructure, regardless of the meeting type. Whether staff is working from home or the office, they should be able to quickly and easily join meetings the same way every time.

- Flexible deployments. Your video solution should adapt to how your organization works, not the other way around. By choosing a flexible solution that can be adapted to your existing tools, systems, and workflows, you’ll save your team time and sanity, while boosting adoption rates for staff members.

Virtual face-to-face meetings can help your bank bridge the gap between digital and in-person consumer banking services to provide the best of both worlds. To learn more about Pexip's flexible solutions for video banking, visit pexip.com/finance.

- Financial services

- Digital transformation

- Personalize customer engagement

- Engage

- Video Platform

.jpeg?width=41&name=Michael%20Whittam%20(1).jpeg)